www tax ny gov online star program

Visit wwwtaxnygovonline and select Log in to access your account. The following security code is necessary to prevent unauthorized use of this web site.

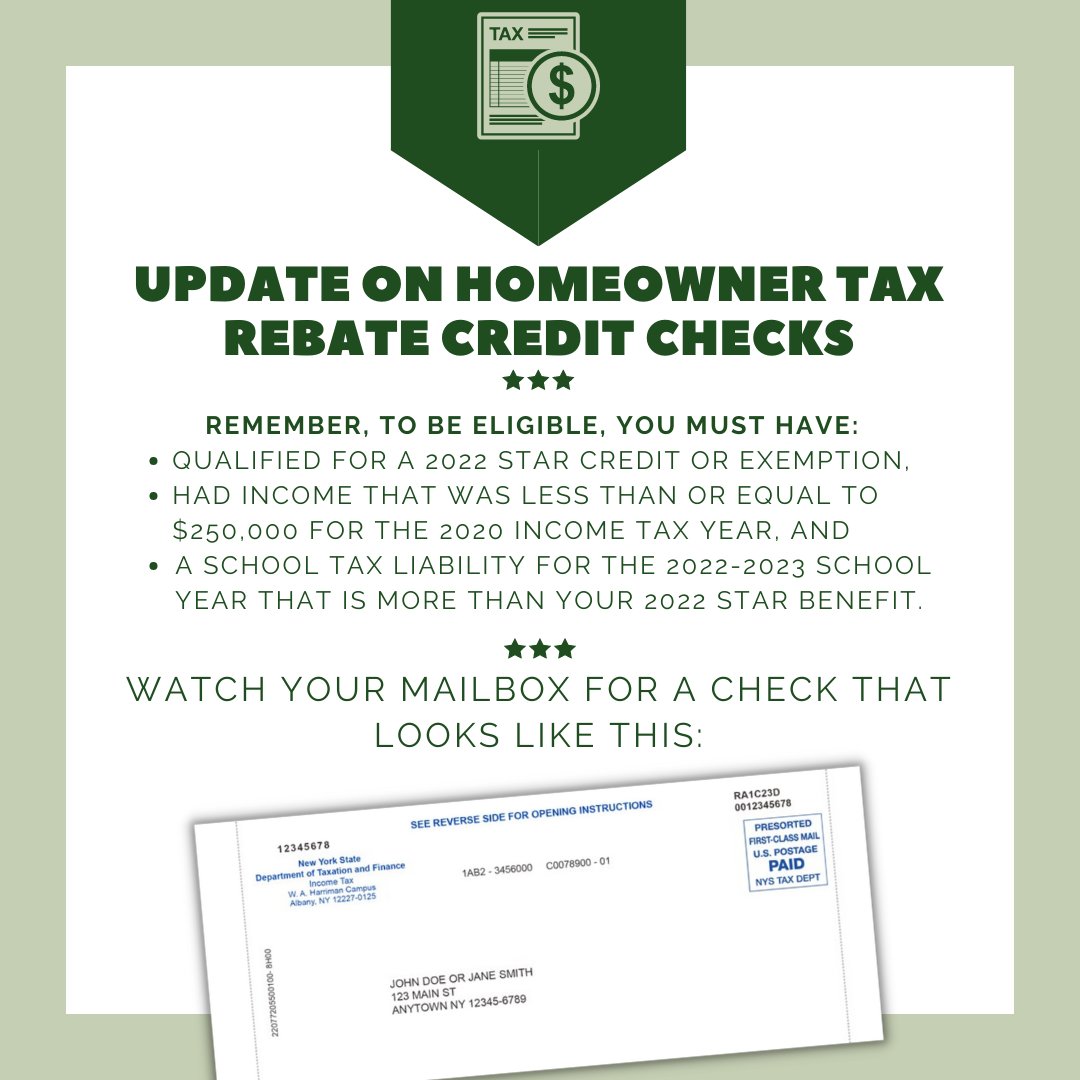

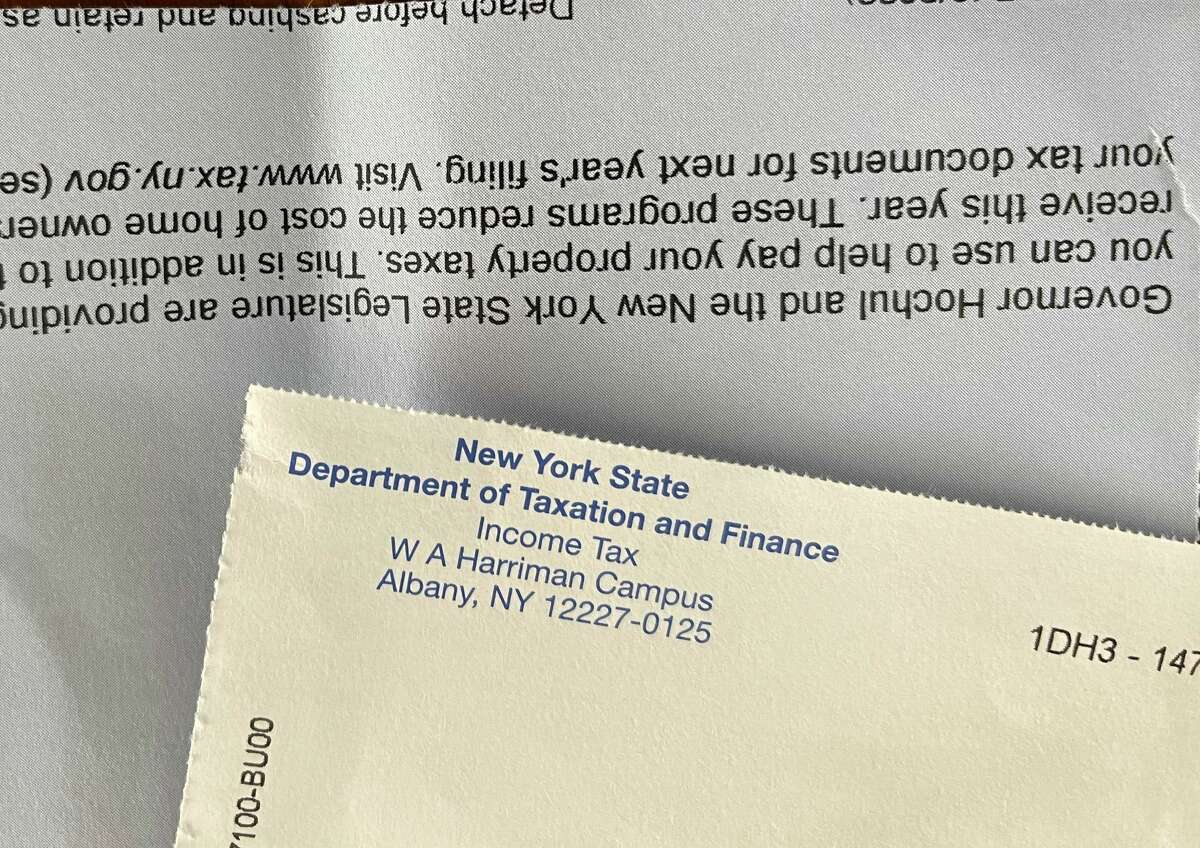

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Tioga Opportunities Inc

Ad No Money To Pay IRS Back Tax.

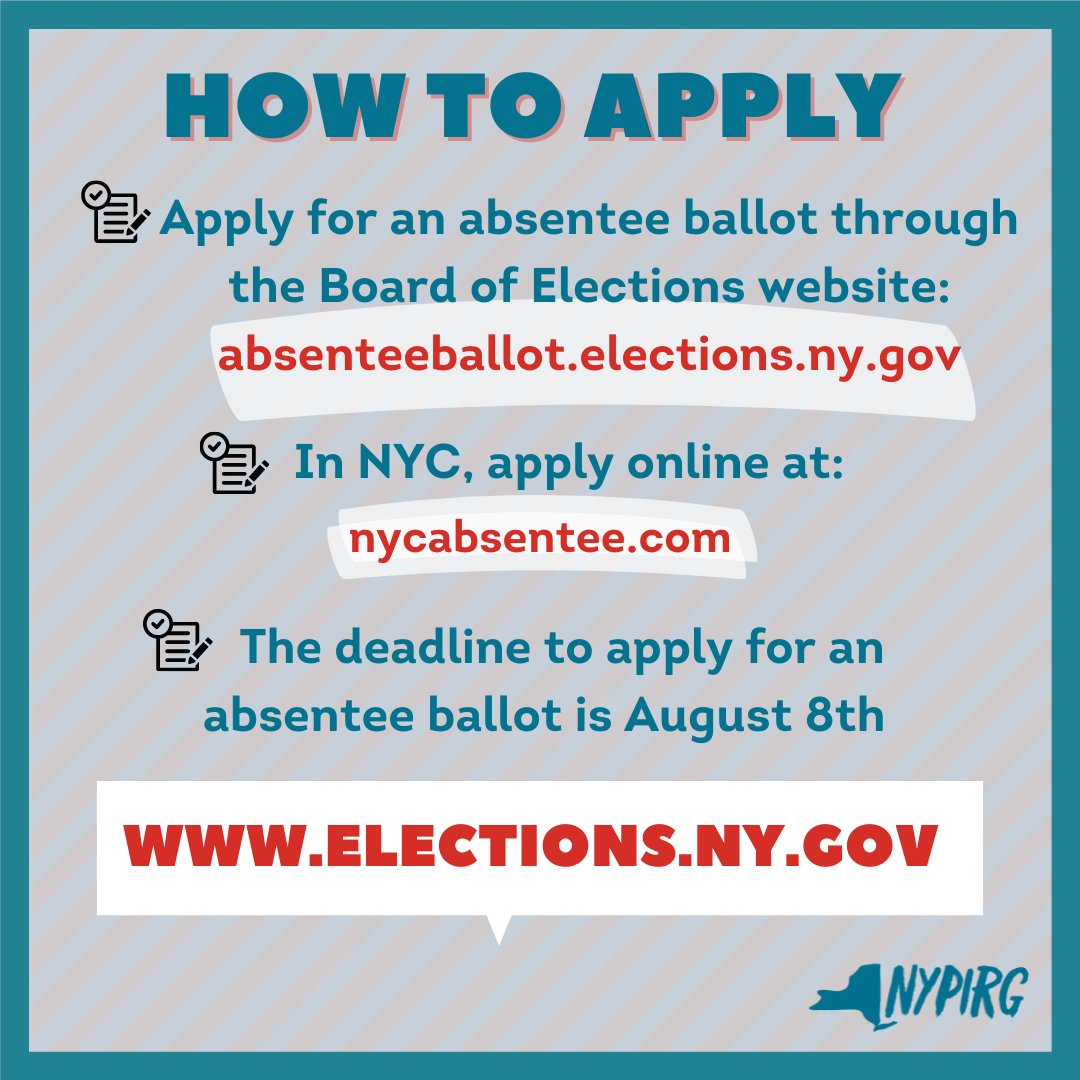

. All New Yorkers who own and live in their one two or three family home condominium cooperative apartment manufactured home or farm dwelling are eligible for a STAR exemption on their primary residence. Enter the security code displayed below and then select Continue. Pritzkers Family Relief Plan also includes several tax holidays and rebates including a suspension of the states sales tax on groceries from July 1 2022 through June 30.

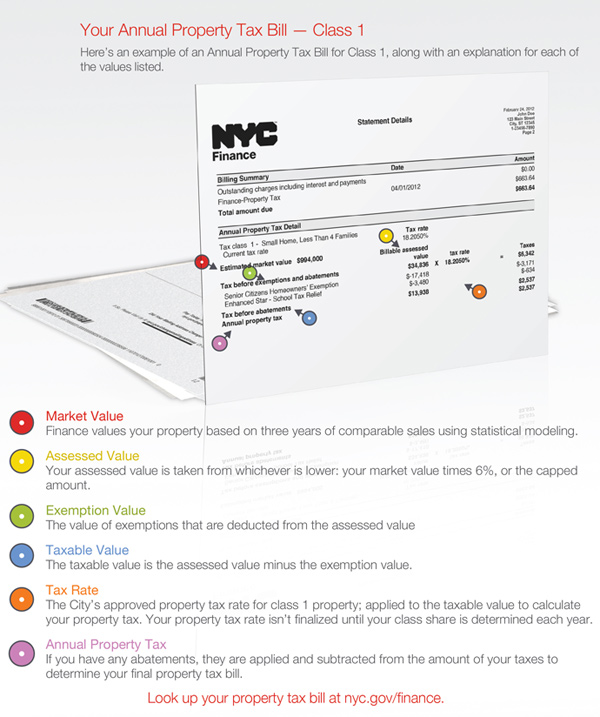

E-File Directly to the IRS State. To be eligible for Basic STAR your income must be 250000 or less. Below you can find a guide to frequently asked questions about the program.

STAR Check Delivery Schedule. The total income of all owners and resident spouses or registered domestic partners cannot. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live.

The School Tax Relief STAR Program FAQ Updated 2021 The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners. No Fees Max Refund Guaranteed. STAR helps lower property taxes for eligible homeowners who live in New York State school districts.

If you have further questions about STAR contact your New York State Senator or call the STAR helpline at 518. You currently receive Basic STAR and would like to apply for Enhanced STAR. We recommend you replace any bookmarks to this.

STAR is New Yorks School Tax Relief Program that provides a partial exemption from school property taxes. Ad Free 2021 Federal Tax Return. If you are using a screen reading program.

We changed the login link for Online Services. New York State Office for the Aging 2 Empire State Plaza Albany New York 12223-1251 Telephone. New York State Office for the Aging 2 Empire State Plaza Albany New York 12223-1251 Telephone.

The following security code is necessary to prevent unauthorized use of this web site. You may be eligible for Enhanced STAR if you will be 65 or older in the calendar year in which you apply. Enter the security code displayed below and then select Continue.

Basic STAR is for homeowners whose total household income is 500000 or less. The benefit is estimated to be a 293 tax reduction. If you are using a screen reading program.

Federal is Always Free NY State Tax Filing Only 1499.

Find 990 Series Forms And Annual Filing Requirements For Tax Exempt Organizations Private Foundation Internal Revenue Service Filing Taxes

New York State Secure Choice Savings Program Board

Rasheed N C Wyatt Rashwyatt Twitter

Welcome To The Nyc Department Of Social Services Dss

Homeowner Tax Rebate Credit Check Lookup

Mobile Manufactured Homes Homes And Community Renewal

New York Property Owners Getting Rebate Checks Months Early

The School Tax Relief Star Program Faq Ny State Senate

210m Upgrade For Grand Central S Subway Unveiled

Renew A License Department Of Financial Services

Receiver Of Taxes Town Of Oyster Bay